Table of Contents

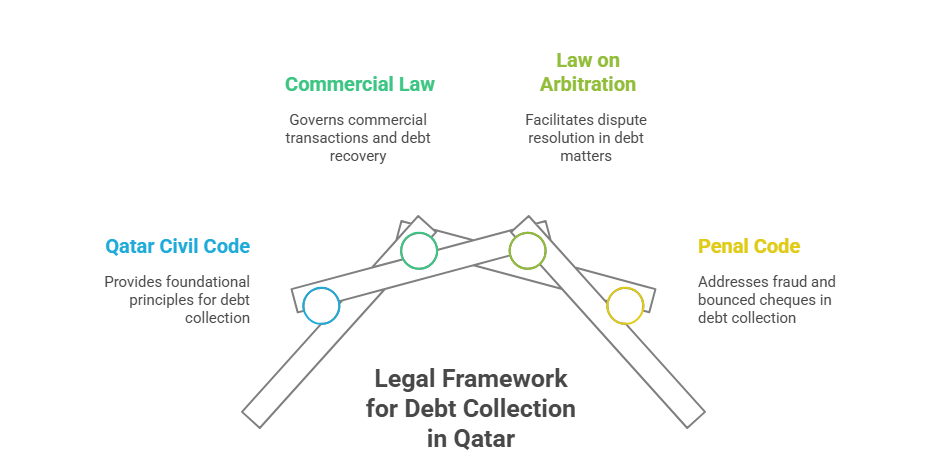

Understanding the Legal Framework in Qatar

Debt collection in Qatar is governed by a combination of civil, commercial, and financial regulations. With the rapid growth of business and personal credit markets, enforcing debt lawfully has become more critical than ever. As of 2025, updates to the enforcement code and court procedures have made the debt collection process in Qatar more structured and transparent.

Overview of Debt Collection Law

The primary legislation regulating debt collection includes:

Debt can be recovered through amicable means or legal action. Contracts, loan agreements, or even oral promises (if provable) can form the basis for a legal claim.

Role of the Civil Code and Ministry of Justice

The Ministry of Justice (MOJ) supervises debt recovery procedures through civil courts. It also oversees the licensing of collection agencies and the application of enforcement mechanisms such as:

- Salary garnishment

- Asset seizure

- Travel bans

The civil courts provide the forum for legal enforcement and are responsible for issuing judgments and orders.

2025 Legal Updates Affecting Debt Collection

In 2025, Qatar updated its debt recovery processes with:

- Digitized court filings for debt cases

- Shortened response timelines for debtors

- Simplified enforcement of judgments

- Expanded jurisdiction of Dispute Resolution Committees

These reforms aim to speed up case resolution and offer better protection to creditors.

The Debt Recovery Procedure Step-by-Step

Sending Legal Notice and Filing a Case

The legal recovery process begins with a formal legal notice. This notice should:

- Specify the amount due

- Reference the original agreement

- Demand payment within 7 to 15 days

If the debtor ignores the notice, the creditor may file a civil case in the appropriate court. Jurisdiction depends on the amount involved and the nature of the dispute.

Required Evidence and Supporting Documents

To file a claim, you need:

- Valid contract or agreement

- Invoices and delivery records (for commercial debts)

- Bank transfer records

- Email or message communications

- Proof of partial payments (if any)

Timeline and Court Process

The general debt collection timeline includes:

- Filing the complaint

- Serving the debtor with notice

- Response period (usually 15–30 days)

- Hearing before the judge or committee

- Issuance of judgment

From filing to judgment, the process may take 2–6 months depending on case complexity.

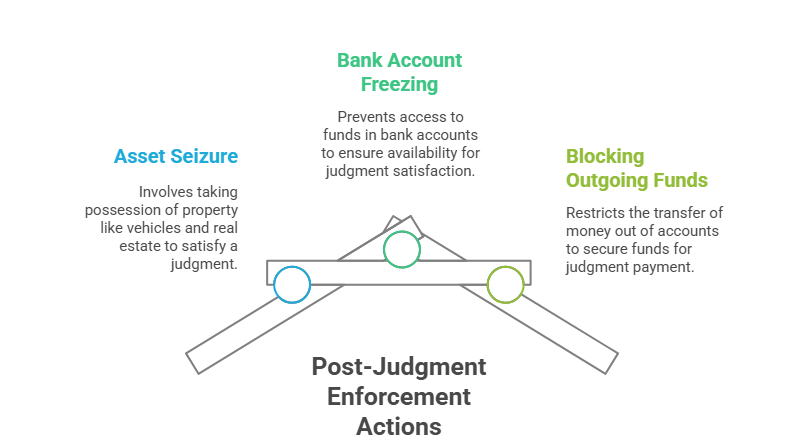

Enforcement After Judgment

Asset Seizure and Bank Account Freezing

Once a judgment is obtained, the court may issue orders to:

These enforcement actions are carried out by court officers in coordination with banks and the police.

Travel Bans and Salary Garnishment

If the debtor attempts to leave Qatar with unpaid obligations, the creditor can request a travel ban through the court.

For employed debtors, the court can issue an order to deduct a percentage of the monthly salary until the full amount is paid.

Enforcing Settlements and Agreements

If a settlement agreement was reached, but the debtor defaults, the court can enforce it as a binding contract, provided both parties signed it before a notary or certified lawyer.

Business Debt Collection Rules

Collecting Debt from Companies and SMEs

Businesses may file claims for:

- Unpaid invoices

- Breach of supply agreements

- Non-payment for goods or services

Commercial disputes often proceed through the Civil and Commercial Court. Legal representation is recommended for corporate claims.

Rules for Unpaid Invoices and Commercial Contracts

- A signed contract is the best evidence.

- Invoices with delivery notes or acknowledgment emails are accepted.

- Even unsigned contracts may be enforceable if performance has occurred.

Rights and Responsibilities of Creditors

Creditors have the right to:

- Seek enforcement through the court

- Negotiate settlements

- Submit claims to dispute resolution bodies

They must not:

- Harass or threaten debtors

- Publicly defame the debtor

- Retain personal documents (e.g., passport)

Working with Debt Collection Agencies

Licensing and Legal Compliance for Agencies

Only licensed debt collection agencies may operate legally in Qatar. They must:

- Follow ethical practices

- Avoid coercion or threats

- Register with the Ministry of Commerce and Industry

Pros and Cons of Hiring an Agency

Pros:

- Faster pre-court recovery

- Lower upfront cost

- Multilingual staff

Cons:

- No power to enforce judgments

- May charge commission (10%–30%)

- Reputational risk if unprofessional

Costs, Processes, and Best Practices

Costs vary, but most agencies work on a success fee basis. Always:

- Ask for a written agreement

- Set a collection deadline

- Monitor agency conduct

Expatriates and Debt Disputes in Qatar

How Expats Can File a Debt Claim

Expats have equal rights under Qatari law. To file a claim, they must:

- Present documents in Arabic (certified translation required)

- Appoint a legal representative (if needed)

- File in the civil court or dispute committee

Consumer Loan Defaults and Legal Consequences

If an expat defaults on a bank loan:

- The bank may file a criminal or civil case

- A travel ban may be imposed

- The debtor’s name may be blacklisted in the Qatar Credit Bureau

Family and Informal Loan Recovery

Informal debts (e.g., personal lending without contracts) are enforceable if there is:

- Bank transfer evidence

- Written acknowledgment via email or message

- Witness testimony

Alternative Dispute Resolution Options

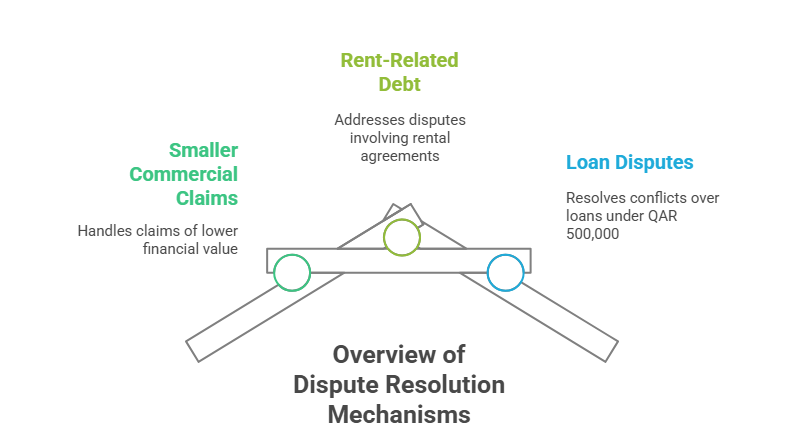

Debt Tribunals and Dispute Committees

The Dispute Resolution Committee under the Ministry of Justice now handles:

This option is faster and more informal than court.

Mediation vs Litigation for Debt Cases

Mediation is suitable for parties willing to settle. A neutral mediator facilitates negotiation. If that fails, the court route remains open.

Litigation is necessary when:

- The debtor refuses to pay

- No agreement is possible

- Enforcement tools are needed

Small Claims Court Procedures

For disputes under QAR 100,000:

- No lawyer is required

- Hearing scheduled within 30 days

- Quick judgments with limited appeals

When to Hire a Lawyer or Law Firm

Legal Representation in Debt Recovery Cases

Hire a lawyer when:

- The amount is high or complex

- You are a foreign party

- The debtor challenges the claim

Lawyers assist with:

- Drafting legal notices

- Filing cases and appeals

- Attending court hearings

Agency vs Law Firm – What’s Right for You?

| Criteria | Debt Collection Agency | Law Firm |

|---|---|---|

| Cost | Lower (commission-based) | Higher (fee-based) |

| Legal authority | None | Full court representation |

| Best for | Pre-court recovery | Legal enforcement |

| Enforcement tools | Not available | Yes |

| Case complexity | Low | Medium to high |

Top Law Firms for Debt Cases in Qatar

Some recommended firms:

- Sultan Al-Abdulla & Partners

- Al Tamimi & Company

- Eversheds Sutherland Qatar

- Dentons Doha Office

These firms offer litigation, mediation, and enforcement support.

Best Practices to Avoid Legal Issues

Drafting Strong Contracts

- Include payment terms, penalty clauses, and dispute resolution methods

- Ensure both parties sign and retain copies

Maintaining Clear Communication and Records

- Use official channels (email, registered mail)

- Document all transactions

- Follow up consistently before legal escalation

Monitoring Payment Terms and Legal Notices

- Set clear due dates

- Send polite reminders before legal notices

- Keep your records legally valid with timestamps and receipts

Final Advice and Resources

Useful Government Links and Portals

- Qatar Ministry of Justice: www.moj.gov.qa

- Civil Court Portal: portal.judiciary.qa

- Qatar Credit Bureau: www.cb.gov.qa

- Dispute Resolution Committees (via MOJ)

When to Settle vs Pursue Enforcement

Settle when:

- The debtor is cooperative

- Legal costs outweigh debt amount

- You want to preserve the relationship

Pursue court enforcement when:

- The debtor is unresponsive

- You need an enforceable judgment

- There are attachable assets

How to Stay Compliant While Collecting Debt in Qatar

- Follow legal notice procedures

- Avoid defamation or coercion

- Respect debtor privacy and legal protections

- Use only licensed representatives or lawyers

Need help with debt collection in Qatar?

Consult a licensed law firm or dispute resolution advisor who understands Qatari law, business culture, and court procedures.

Disclaimer: This article provides general information and should not be construed as legal advice. Please consult with a qualified and experienced lawyer for personalized guidance regarding your specific situation.