Table of Contents

Understanding Cheque Bounce Cases in Qatar

In Qatar, the crime of issuing a bounced cheque is serious and financial as well as legal. You are a Qatari or an expatriate who issues a cheque that bounces due to insufficient funds in the account, a discrepancy in the signature, or a stop order. It can result in criminal prosecution and other legal punishments.

Understanding the bounced cheque case procedures in Qatar is crucial if you're involved in business, property dealings, or any financial transactions.

What Is a Bounced Cheque in Qatar?

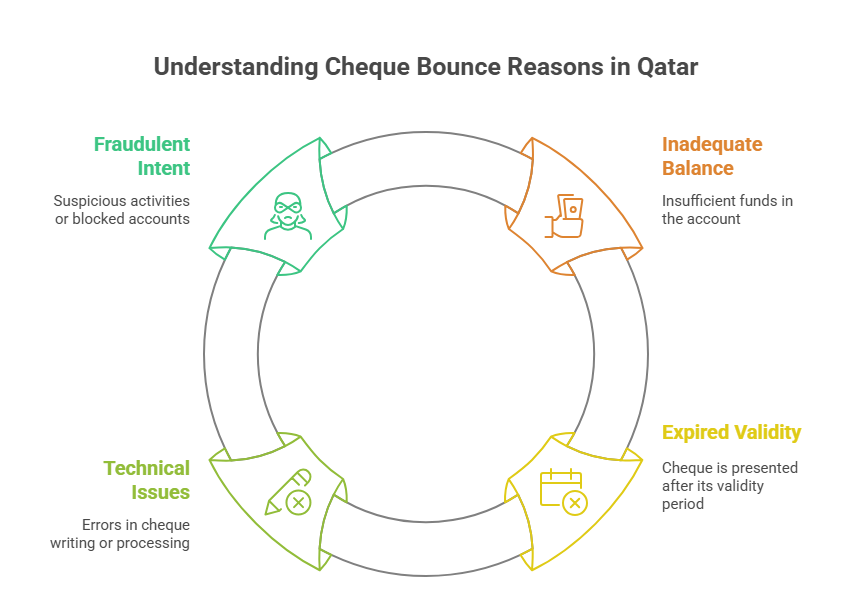

A bounced cheque, also referred to as a dishonored cheque, occurs when a cheque presented to a bank cannot be processed due to reasons such as:

-

Insufficient funds

-

Account closure

-

Mismatch in signature or overwriting

-

Stop-payment instructions

Common Reasons Cheques Bounce in Qatar

Legal Framework for Bounced Cheques in Qatar

Is Bounced Cheque a Criminal Offense in Qatar?

Yes. Under Qatari law, issuing a cheque without sufficient funds is a criminal offense. The legal framework is governed by the Qatar Penal Code and updated provisions from Qatar Central Bank regulations.

Qatar Penal Code on Cheque Bounce Cases

The Qatar Penal Code Article 357 clearly outlines the criminality of issuing cheques with bad intent or insufficient funds. As of 2025, new amendments focus more on reconciliation and debt recovery while retaining penal actions for willful defaulters.

Criminal vs. Civil Cases: What You Need to Know

-

Criminal Case: Initiated for fraudulent or intentional default. Can lead to jail time and blacklisting.

-

Civil Case: Focuses on debt recovery through legal mediation and payment settlements.

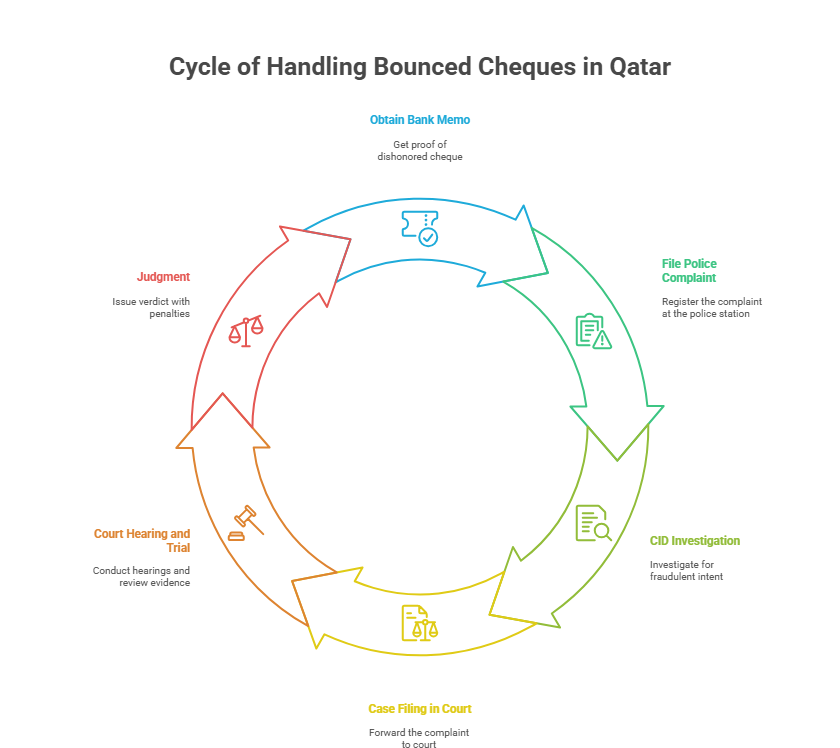

Legal Procedure to Handle a Bounced Cheque

Step-by-Step Process to File a Bounced Cheque Case in Qatar

How to Get Bail in Cheque Bounce Case in Qatar

If arrested, the accused can apply for bail based on the cheque amount and history. A lawyer's assistance is highly recommended to prepare the bail application.

Penalties and Consequences of a Bounced Cheque

Jail Time and Fines

-

Up to 3 years of imprisonment depending on cheque value and intent

-

Fines starting from QAR 3,000 to over QAR 50,000

-

Possible travel bans and passport hold

Penalties for Expats and Business Owners

Expats may face visa cancellation, employment termination, and deportation if found guilty. Businesses can be blacklisted by banks.

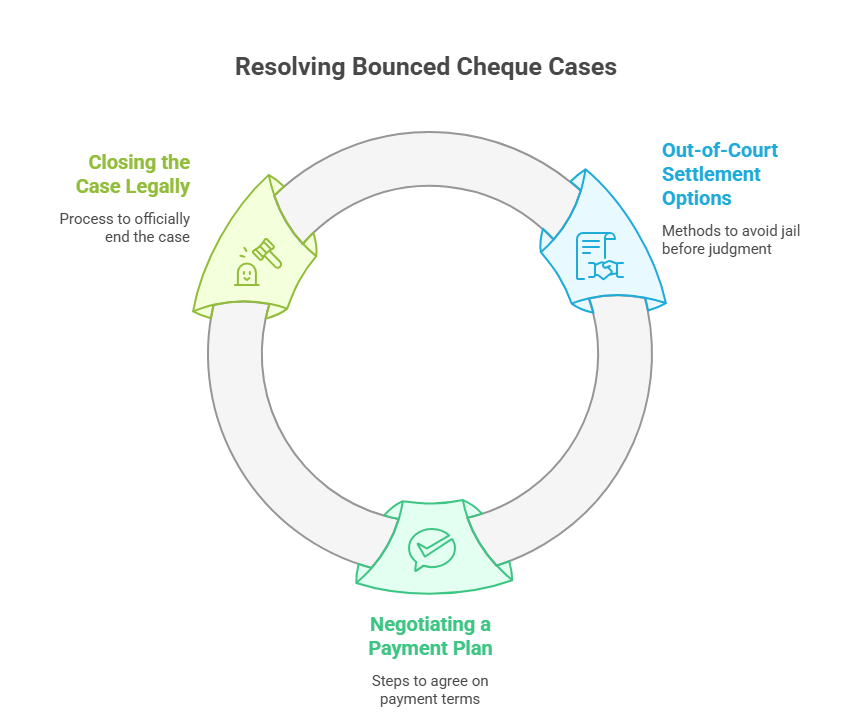

Legal Rights and Appeal Options

Defendants have the right to appeal court decisions, submit evidence of repayment, or request settlement mediation.

Role of Banks in Cheque Bounce Cases

How Banks Handle Returned Cheques

-

Bank issues a Cheque Return Memo explaining the reason

-

Notifies the account holder and retains a copy

Bank Charges and Fees for Bounced Cheques in Qatar

-

Standard bounced cheque fee: QAR 100 - 300 depending on the bank

-

Charges are deducted automatically from the account

Can a Bank Blacklist You for Bounced Cheque in Qatar?

Yes, if repeated offenses are noticed. A blacklisted individual cannot open new bank accounts or apply for loans.

How to File a Bank Complaint for Bounced Cheques

Customers can file a written complaint at the bank branch or through the Qatar Central Bank grievance portal.

Expat-Focused Advice

Special Legal Considerations for Foreign Nationals

Expatriates must be cautious, as bounced cheques are treated more seriously for non-citizens.

Common Pitfalls Expats Face

-

Unfamiliarity with Qatar's cheque laws

-

Delays in salary resulting in insufficient balance

-

Reliance on post-dated cheques

Legal Support and Rights for Expats

-

Expats can appoint a legal representative or hire an attorney

-

Consular assistance may be available via your country’s embassy

Settling a Bounced Cheque Case

Preventive Measures

Writing Valid Cheques in Qatar

-

Ensure sufficient funds are in account

-

Avoid overwriting or post-dating

-

Sign clearly and legibly

Rules and Validity Periods

-

Cheques are valid for 6 months in Qatar

-

Cheques older than that are considered legally expired

Tips to Avoid Future Issues

-

Use bank transfers or official contracts instead of post-dated cheques

-

Keep a record of all financial transactions

Government Regulations & 2025 Updates

Qatar Central Bank Guidelines

The QCB guidelines as of 2025 emphasize reconciliation, requiring banks to report repeated offenders.

2025 Updates on Cheque Laws

-

More emphasis on civil settlements over jail time

-

Encouragement for digital payments and e-cheques

-

Enhanced support for business owners and expats

Reporting Financial Fraud in Qatar

Fraud or misuse of cheques can be reported to:

-

Ministry of Interior (MOI)

-

Qatar Central Bank (QCB)

-

Your local police station

Final Thoughts

If you're dealing with a bounced cheque case in Qatar, understanding the legal steps, possible penalties, and preventive strategies is crucial. Always ensure proper documentation, stay updated on 2025 law amendments, and seek legal support when needed.

Pro Tip: To avoid severe consequences, resolve the matter quickly through mutual settlement or official legal representation.

Need Legal Help?

Consider hiring a professional lawyer in Qatar specializing in financial crimes, civil litigation, or corporate law to guide you through the process and safeguard your rights.

Disclaimer: This article provides general information and should not be construed as legal advice. Please consult with a qualified and experienced lawyer for personalized guidance regarding your specific situation.