Table of Contents

Understanding Debt Collection Laws in Qatar

Debt collection in Qatar is governed by a mix of civil, commercial, and criminal laws that aim to ensure fairness between creditors and debtors. Whether it's a bounced cheque, unpaid invoice, or unresolved personal loan, recovering debt in Qatar follows a structured legal process.

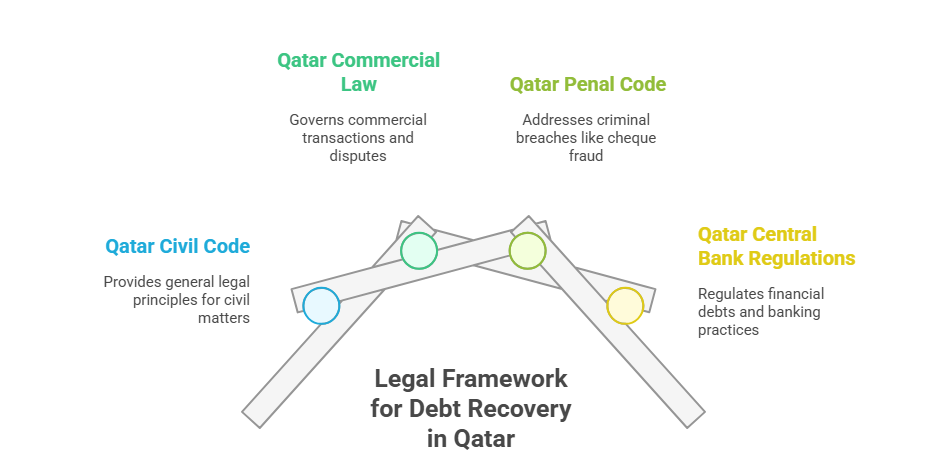

Key Legal Provisions in Debt Recovery

The core legal frameworks include:

These regulations protect the rights of both parties while discouraging fraudulent or negligent behavior.

Statute of Limitations and Court Jurisdiction

In Qatar, the statute of limitations for filing a civil debt case is generally 15 years, although certain commercial claims may have shorter periods. All debt recovery cases are handled under the Qatar Civil and Commercial Court, with small claims often falling under simplified procedures.

Legal Procedures for Debt Recovery

How to Send Legal Notice for Debt

Before filing a lawsuit, the creditor typically sends a formal legal notice to the debtor. This includes:

-

Amount due

-

Deadline for repayment (usually 7 to 14 days)

-

Threat of legal consequences upon non-payment

Legal notices should be delivered via registered post or a legal advocate to be admissible in court.

Filing a Case Through the Civil Court

If the debtor ignores the notice, the next step is to file a civil suit. This involves:

-

Submitting the legal claim with all evidence

-

Paying court fees (based on claim amount)

-

Attending hearings with legal counsel

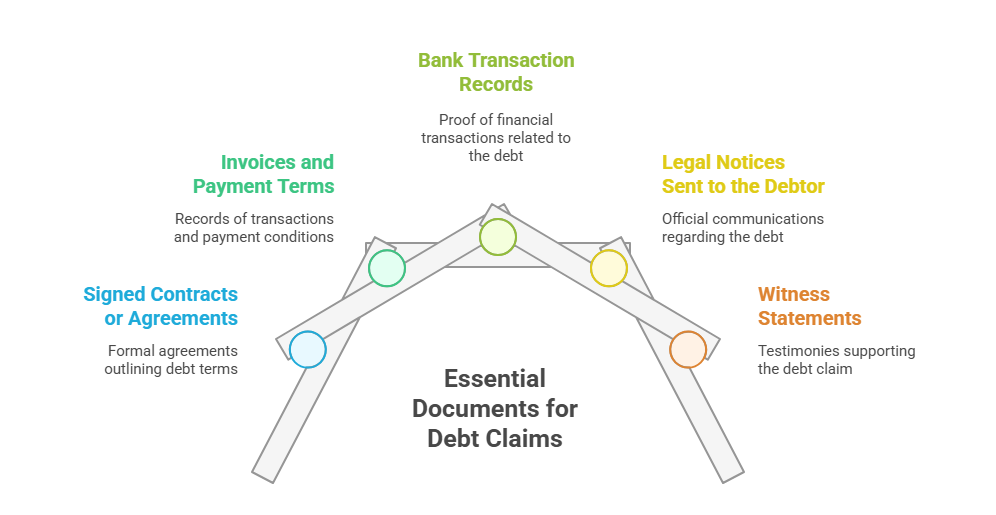

Required Documentation for Debt Claims

Documents typically required include:

Enforcing Debt Through Judgments

Once the court issues a favorable judgment, the creditor can enforce it via:

-

Bank account seizure

-

Salary garnishment

-

Asset attachment (e.g., vehicles, property)

-

Legal travel bans

Types of Debt and How to Recover Them

Personal and Business Debt Recovery

Debt can be personal (e.g., unpaid loans between individuals) or commercial (e.g., unpaid B2B invoices). Both follow the same general legal process but may differ in documentation and enforcement strategies.

Rent Arrears and Salary Loans

Landlords can claim rent arrears by submitting tenancy contracts and unpaid rent records. Employers can reclaim salary loans through employment contracts and signed acknowledgment of debt.

Credit Card and Bank Loan Defaults

Banks and financial institutions often initiate debt collection through internal teams or licensed third-party agencies. In the case of credit card debt, bounced EMIs or non-payment can lead to criminal cases under cheque fraud laws.

Partner Loan and Contractual Debt

Debt disputes among business partners can be complex. If no formal contract exists, WhatsApp messages, emails, or verbal agreements may be considered, though they carry lower legal weight.

Working with Debt Collection Agencies

Licensed Agencies and Third-Party Firms

Debt collection agencies in Qatar must be licensed by relevant government bodies. They handle collection on behalf of creditors and may use:

-

Follow-up notices

-

Phone/email reminders

-

Legal threat letters

When to Outsource Debt Collection

Consider hiring a professional agency when:

-

Debt is over 60 days overdue

-

You lack resources to follow up

-

The debtor is ignoring direct communication

Costs, Risks, and Legal Compliance

Typical fees range from 10–25% of recovered amounts. Reputable agencies operate within legal limits and do not use force or harassment.

Legal Representation in Debt Collection

When You Need a Debt Recovery Lawyer

If the debt involves large sums, international parties, or court action, hiring a debt recovery lawyer in Qatar is essential. Lawyers:

-

Draft legal notices

-

File and argue the case

-

Represent you in enforcement proceedings

Hiring the Right Attorney or Law Firm

Look for:

-

MOJ-licensed legal professionals

-

Specialization in commercial and civil litigation

-

Knowledge of Arabic and English legal systems

Role of Advocates and Legal Consultants

Legal consultants can assist in:

-

Contract drafting

-

Risk mitigation

-

Preventing future bad debts

Debt Recovery for Expats in Qatar

How Expats Can File Debt Claims

Expats have full legal rights to file debt claims. Steps include:

Gathering evidence

Consulting a bilingual lawyer

Ensuring the case complies with Qatari civil law

Expat Rights and Legal Protections

Qatar courts do not discriminate between nationals and expats.

However, documents in Arabic are preferred. Legal interpreters are available.

Leaving Qatar with Unpaid or Owed Debt

If you're an expat planning to leave Qatar:

Settle all outstanding debts to avoid legal blocks

Creditors may place travel bans until debts are cleared

Government Bodies and Regulation

Qatar Central Bank and MOJ Involvement

QCB oversees financial debt regulations, while the Ministry of Justice (MOJ) manages court processes and enforcement.

Financial Dispute Tribunals and Reforms

Qatar is improving access to justice with specialized financial tribunals for faster resolutions. In 2025, new legislation promotes:

-

Digital filing of debt claims

-

Online hearings

-

Mediation support via the Dispute Settlement Committee

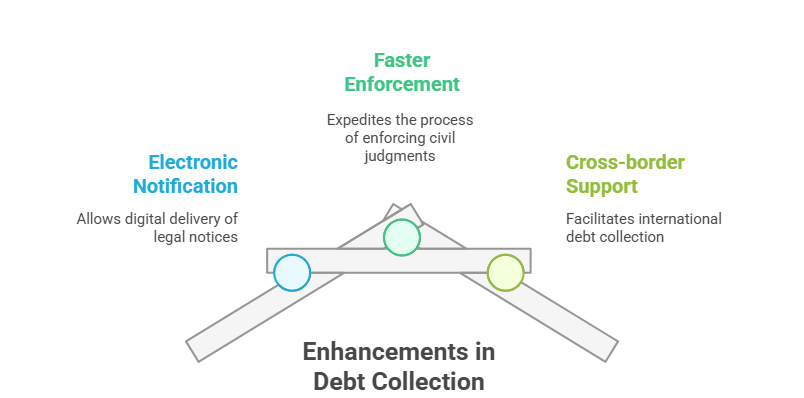

2025 Updates in Debt Collection Policies

New laws in 2025 allow:

Best Practices for Creditors and Debtors

Clear Contracts and Payment Terms

Always use legally binding written contracts with:

-

Defined payment terms

-

Late payment clauses

-

Penalty clauses

Documentation and Communication Logs

Maintain:

-

Signed documents

-

Email trails

-

Payment follow-ups

-

Delivery receipts

Avoiding Legal Traps in Debt Recovery

-

Avoid informal cash lending

-

Don’t threaten or harass debtors

-

Never withhold passports or personal documents

Final Advice

When to Settle vs When to Litigate

Litigation is costly and time-consuming. If the debtor shows willingness, consider:

-

Installment plans

-

Settlement agreements

-

Third-party mediation

Trusted Legal and Collection Services

Choose lawyers or agencies with experience in:

-

Commercial disputes

-

Enforcement orders

-

Debt negotiation and settlement

Future of Debt Collection in Qatar

Qatar is moving towards a more digitized and streamlined legal framework. With e-courtrooms, AI-powered case tracking, and updated civil codes, debt collection will become faster, safer, and more transparent in the coming years.

Need legal assistance with debt recovery? Contact a licensed Qatari law firm specializing in civil enforcement and financial dispute resolution.

Disclaimer: This article provides general information and should not be construed as legal advice. Please consult with a qualified and experienced lawyer for personalized guidance regarding your specific situation.